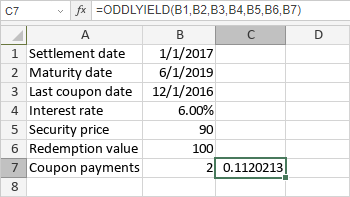

ODDLYIELD Function

The ODDLYIELD function is one of the financial functions. It is used to calculate the yield of a security that pays periodic interest but has an odd last period (it is shorter or longer than other periods).

The ODDLYIELD function syntax is:

ODDLYIELD(settlement, maturity, last-interest, rate, pr, redemption, frequency[, [basis]])

where

settlement is the date when the security is purchased.

maturity is the date when the security expires.

last-interest is the last coupon date. This date must be before the settlement date.

rate is the security interest rate.

pr is the purchase price of the security, per $100 par value.

redemption is the redemption value of the security, per $100 par value.

frequency is the number of interest payments per year. The possible values are: 1 for annual payments, 2 for semiannual payments, 4 for quarterly payments.

basis is the day count basis to use, a numeric value greater than or equal to 0, but less than or equal to 4. It is an optional argument. It can be one of the following:

| Numeric value | Count basis |

| 0 | US (NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |

Note: dates must be entered by using the DATE function.

The values can be entered manually or included into the cell you make reference to.

To apply the ODDLYIELD function,

- select the cell where you wish to display the result,

-

click the Insert function

icon situated at the top toolbar,

icon situated at the top toolbar,

or right-click within a selected cell and select the Insert Function option from the menu,

or click the icon situated at the formula bar,

icon situated at the formula bar,

- select the Financial function group from the list,

- click the ODDLYIELD function,

- enter the required arguments separating them by commas,

- press the Enter button.

The result will be displayed in the selected cell.