IPMT Function

The IPMT function is one of the financial functions. It is used to calculate the interest payment for an investment based on a specified interest rate and a constant payment schedule.

The IPMT function syntax is:

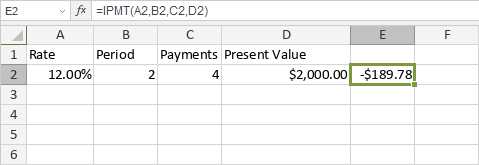

IPMT(rate, per, nper, pv [, [fv] [,[type]]])

where

rate is the interest rate for the investment.

per is the period you want to find the interest payment for. The value must be from 1 to nper.

nper is a number of payments.

pv is a present value of the payments.

fv is a future value (i.e. a cash balance remaining after the last payment is made). It is an optional argument. If it is omitted, the function will assume fv to be 0.

type is a period when the payments are due. It is an optional argument. If it is set to 0 or omitted, the function will assume the payments to be due at the end of the period. If type is set to 1, the payments are due at the beginning of the period.

Note: cash paid out (such as deposits to savings) is represented by negative numbers; cash received (such as dividend checks) is represented by positive numbers. Units for rate and nper must be consistent: use N%/12 for rate and N*12 for nper in case of monthly payments, N%/4 for rate and N*4 for nper in case of quarterly payments, N% for rate and N for nper in case of annual payments.

The numeric values can be entered manually or included into the cell you make reference to.

To apply the IPMT function,

- select the cell where you wish to display the result,

- click the Insert Function

icon situated at the top toolbar,

icon situated at the top toolbar,

or right-click within a selected cell and select the Insert Function option from the menu,

or click the icon situated at the formula bar,

icon situated at the formula bar,

- select the Financial function group from the list,

- click the IPMT function,

- enter the required arguments separating them by commas,

- press the Enter button.

The result will be displayed in the selected cell.